And it can getting exactly as difficult if this is their next time. Reusing Va entitlements includes numerous questions regarding financing constraints, how much cash entitlement you’ve got left, and.

Up coming, you estimate exactly how much you really have in line with the county’s loan restrict and you will circulate towards the getting the property you have always wished.

What exactly are First and Level dos Va Entitlements?

This gives their lender count on to allow them to provide the Virtual assistant Financing which have no downpayments and no PMI. And it also will bring a special possible opportunity to convey more than just step 1 Va Loan at a time.

If you have never utilized entitlement before or even the Company away from Pros Factors (VA) has renewed their entitlement, starting with what exactly is titled Basic Entitlement. Its $thirty six,100 to own home loans around $144,000.

Pros and active-obligations servicemembers qualify for Level 2 Entitlement (often referred to as extra entitlement) when you’re choosing property more than $144,000. The new Va pledges $thirty-six,100 off Basic Entitlement and you can twenty-five% of your county’s loan maximum.

Along with her, both types of entitlement merge as your Complete Entitlement, giving you many currency it is possible to to find a home.

Figuring Your own Remaining Virtual assistant Entitlement

Figuring the left Va Entitlement you are able to do yourself or with a skilled bank. Earliest, second Level, and kept entitlement calculations may be the most frequent we come across having our home buyers we work at.

Basic Entitlement Formula

You will get $thirty-six,100 into the first entitlement about Va whenever you are amount borrowed is actually around $144,100. The brand new Certificate regarding Qualifications (COE) says to if your stil bring Earliest Entitlement or perhaps not.

We’ve viewed customers look for attractive residential property within the Tennessee and you will North carolina where finances and you may discover money in case of standard.

next Level Entitlement Calculation

With the aid of a beneficial Va bank, it is possible to capture 25% of your county’s Virtual assistant Financing Maximum and determine extent from entitlement after you have used the first upwards.

A familiar scenario there is noticed in Washington is actually readers one to move so you can Maricopa State. As mortgage restriction is actually $647,2 hundred, you’ll be qualified to receive a second Tier Entitlement regarding $161,800.

Remaining Entitlement Formula

You really have currently made use of the $thirty six,000 First Entitlement and you will precisely what the Virtual assistant phone calls full entitlement however, want to buy another assets.

In these instances, a skilled lender take you step-by-step through a straightforward formula in order to determine the left entitlement. They refer returning to the last Virtual assistant Loan and employ it getting training the new matter.

It’s also possible to move to the new Vanderberg Heavens Force Feet into the Ca on account of a great PSC, although not have entitlement leftover.

Which have made use of all entitlement, the Va do bring 25% of the new county’s Va Loan Maximum ($783,150 inside Santa Barbara) and you will deduct the fresh new entitlement you have used of it.

Va Lenders do not require an advance payment so long as your remain in the Basic and you will next Level Entitlement numbers. For those who go beyond, the lending company wants money down to include the investment.

It’s also possible to use the Virtual assistant Mortgage to buy a property which have an optimum amount borrowed which is equivalent to or below the rest entitlement.

We think this is your family’s turn-to alive the brand new Western Dream and revel in this great Nation you sacrificed to have. From the working with an experienced Va Bank, they will help you to get the most significant fuck for your Va entitlement dollars.

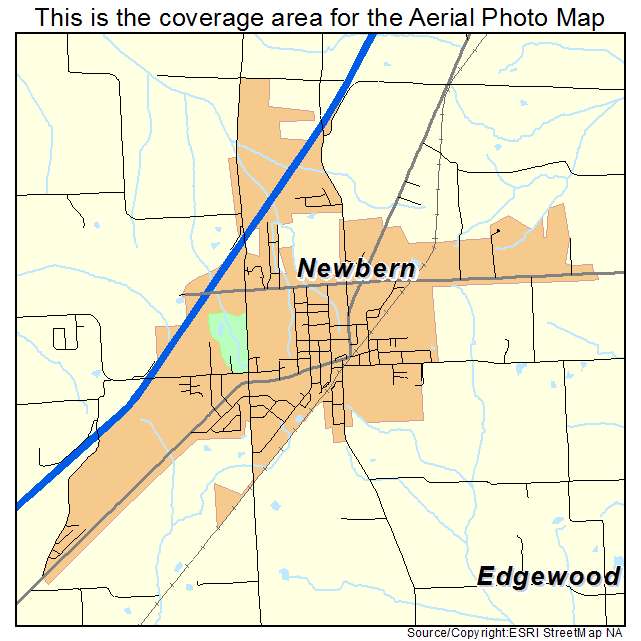

Va Loan Restrict by the Condition

The new Virtual assistant is a federal government service one to knows you and your mate tends to be stationed or retiring from inside the a more high priced region of the country, including California. It to alter Va Loan Limits with regards to the cost-of-living of form of state.

You can get your perfect house with trust knowing loans Higganum CT the Va will provide sufficient. Celebrating your own military service, the brand new Dept. of Experts Items prize you with a lot of bucks to help you enjoy which have a zero advance payment financial.

Take a look at the more compliant financing limits per state. Most states feel the standard Virtual assistant Mortgage Limitation from $647,200 to make it easy to assess your second level entitlement.

Entitlement to own First-Go out otherwise Experienced Buyers

Virtual assistant Entitlement is for any productive-duty solution affiliate otherwise seasoned that is ready to choose the family its family’s usually wanted. It is a perfect for you personally to buy a home close the route or even to settle down close family unit members on your own last domestic.

I have a group of military-manage lenders one to understand the means of to acquire a first otherwise next house or apartment with brand new Va Loan. The employees is ready to reply to your inquiries and you can go you from the Va Loan Excursion action-by-step.

Contact us today on (480)-569-1363, so we can award you for your newest otherwise previous military services to that particular High Nation.